Your cart is currently empty!

Protection Put Write-offs Checklist What significant link Local rental Destroy Could cost

Content

Their secretary was guilty of responding and you may following through to all your inquiries today and relaxed after. The fulfillment is our very own priority plus research of your/the woman will establish work score. Consumer could possibly get shell out ½ out of put prior to solution initiation plus the equilibrium to the earliest bill. Do not are Personal Security quantity or any private or confidential information. So it Yahoo™ interpretation ability, provided on the Business Tax Panel (FTB) site, is actually for general advice only.

Delight discover a duplicate of the policy for an entire conditions, standards and you can conditions. Exposure conditions is hypothetical and you may shown to own illustrative objectives simply. Visibility will be based upon the actual points and things providing go up in order to a declare. Shell out a little fee every month only $5 rather than a large initial security put. Disputes usually go prior to a judge (there are no juries) in a month otherwise a few. People get sue to your shelter put count which they trust the proprietor wrongfully withheld, around the official’s restrict.

Societal Protection Pros | significant link

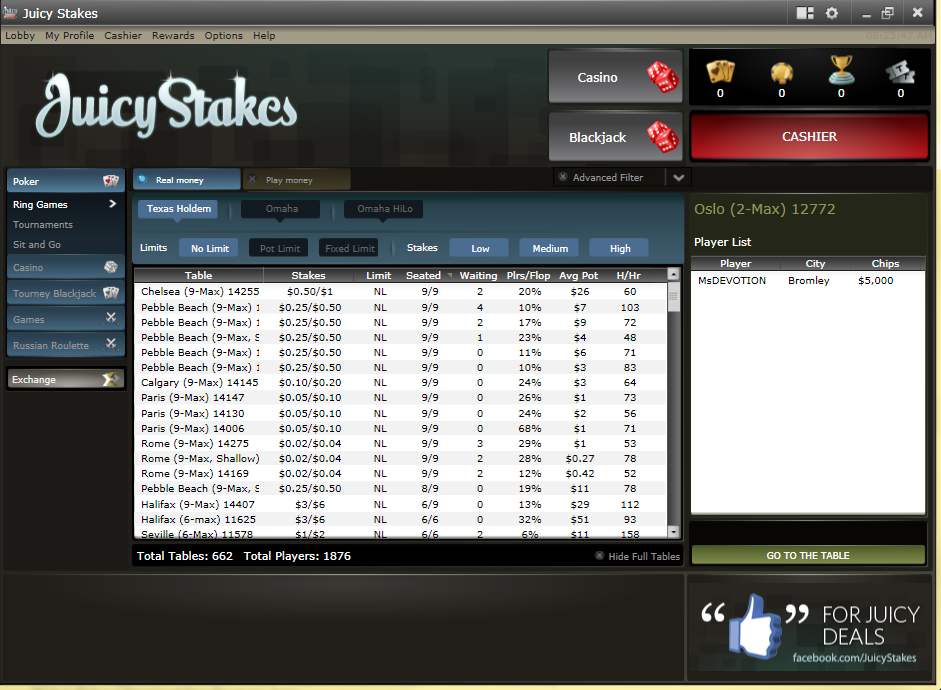

Certain $5 deposit gambling enterprises enable it to be participants to allege bonuses as high as $20. Bonuses like this allows you to play a lot more than you could have with only a $5 put. The amount of the put shouldn’t change the result of the online game. But not, it can probably take you some more victories to cash out a good amount in the a great $5 minimal put casino. Yet not, you might come across specific games in a few step 1 dollars deposit gambling enterprises having at least bet that is more than the fresh $5 your placed. It will always be good to consider for each and every game’s requirements and you will constraints beforehand, so you wear’t occur to spend your own $5 deposit on the a casino game you can’t play.

Mount a duplicate from federal Setting 1066 on the back of the fresh done Form 541. Home Withholding Declaration – Active January step one, 2020, the true estate withholding models and you may recommendations have been consolidated to your one the brand new Function 593, A house Withholding Statement. The credit is actually 50% of one’s number shared by the taxpayer to the taxable 12 months on the College or university Accessibility Tax Borrowing from the bank Finance. The amount of the credit is designated and you can official by the CEFA. To learn more go to the CEFA website at the treasurer.ca.gov and search to own catc.

Withholding for the Idea Income

Their faithful membership movie director as well as your Panama lawyer often praise and you can make suggestions through this processes.If you’d like to incorporate your organization, we’ll deal with the method for you. Don’t are withholding away from Versions 592-B or 593 or nonconsenting nonresident (NCNR) member’s income tax away from Plan K-step one (568), Member’s Display of money, Deductions, Loans, etcetera., range 15e about this range. IRC Area 469 (and that California incorporates by the site) generally limitations write-offs of couch potato things to the quantity of income produced from the passive points. Likewise, loans from inactive things is limited to income tax due to such points. These limitations are first used from the property or faith height. Get the instructions for federal Function 8582, Inactive Pastime Losings Limits, and you may federal Mode 8582-CR, Inactive Interest Credit Limitations, for more information on inactive items loss and you will credit limitation laws.

The $5 significant link lowest put casinos on the internet read repeated audits to have video game fairness and player protection. Among the recognized certificates you to secure our believe are those away from the uk Gaming Percentage, the new MGA, and the iGaming Ontario otherwise AGCO licenses. We recommend searching for it give, specifically if you like to play slot games.

Additional Advantages of choosing Baselane

A homes fringe work with boasts payments to you otherwise on your part (plus family’s should your loved ones resides to you) only for the next. The earnings and just about every other compensation for functions did from the You are thought getting out of source regarding the Joined Says. The only real conditions to that rule try chatted about less than Personnel away from international individuals, teams, otherwise organizations, after, and you can lower than Team players, before. More often than not, bonus earnings acquired of domestic companies is actually You.S. source money. Dividend money out of foreign companies can be foreign source earnings.

Moneylines

Such earnings is generally excused away from U.S. income tax or may be subject to a lesser price out of income tax. To choose income tax on the nontreaty earnings, contour the brand new income tax at the either the brand new apartment 31% speed and/or graduated speed, depending upon whether the money are effectively associated with the trading or company in the usa. A great nonresident alien is to explore Function 1040-Es (NR) to find and you may pay projected taxation. For those who pay by the look at, allow it to be payable to “You Treasury.” If you feel that your self-work money try subject simply to You.S. self-work income tax that is exempt from foreign social protection taxation, request a certification out of Exposure regarding the SSA. It certificate will establish your exclusion from foreign societal defense fees.

Every piece of information within this guide isn’t as complete for citizen aliens as it is to have nonresident aliens. Citizen aliens are handled like You.S. residents and can see more details various other Internal revenue service courses at the Irs.gov/Variations. When you generate in initial deposit, you receive 80 totally free spins while the an advantage.

The newest believe tool provides one to money progress are added to corpus. 50% of one’s fiduciary charges is actually allocated to money and you can fifty% to help you corpus. The brand new believe obtain $step 1,five hundred out of miscellaneous itemized deductions (chargeable in order to earnings), which are susceptible to the two% floors. The newest trustee generated a good discretionary distribution of your own accounting earnings out of $17,500 on the believe’s best beneficiary. Allowable administration prices are the individuals will cost you that were obtain inside connection on the administration of one’s estate or believe that would not was sustained in case your possessions were not stored in such home or believe. Trust costs according to external investment suggestions and you can funding government charges try miscellaneous itemized deductions susceptible to the 2% floors.

Matches incentives or put fits bonuses often match your $5 put local casino finest-as much as a specific the amount, normally at the 50% or a hundred%, even when almost every other rates can get use. When you’re such now offers are typical, they don’t constantly expand since the much that have shorter deposits, so you might maybe not comprehend the exact same boost just as in large top-ups. Ruby Luck is a $5 deposit gambling establishment one pledges the fresh invited bonus out of C$250. We recommend which local casino since it offers more 1,000 game and you may a mobile software. Centered inside 2003, it is one of the recommended $5 deposit gambling enterprises in the Canada. Join The Slots Local casino and you can open a c$step 1,five hundred inside incentive finance spread around the very first around three places, in addition to ten 100 percent free revolves every day and you can a shot during the effective up to C$1,000,100.