Your cart is currently empty!

Assistance to Firefighters Gives System

Articles

Webinars should include helpful information to aid applicants inside successfully finishing the app. This season, software a knockout post webinars is pre-filed so that people to get into during the the comfort. Website links to the FY 2024 Safe and FP&S webinars might possibly be posted soon on the Help Firefighters Give Software Working area webpage.

Investing The Fees

Yet not, of a lot low-resident services as an alternative citation the price of the fresh withholding demands to the payors. Budget 2024 offers to remove the tax-indifferent trader exception (including the replace exchanged exclusion) on the anti-protection rule. So it size manage clarify the newest anti-protection code and prevent taxpayers out of claiming the fresh dividend obtained deduction to own returns received for the a portion in respect where here is actually a plastic material security plan.

Adjustments to help you Income

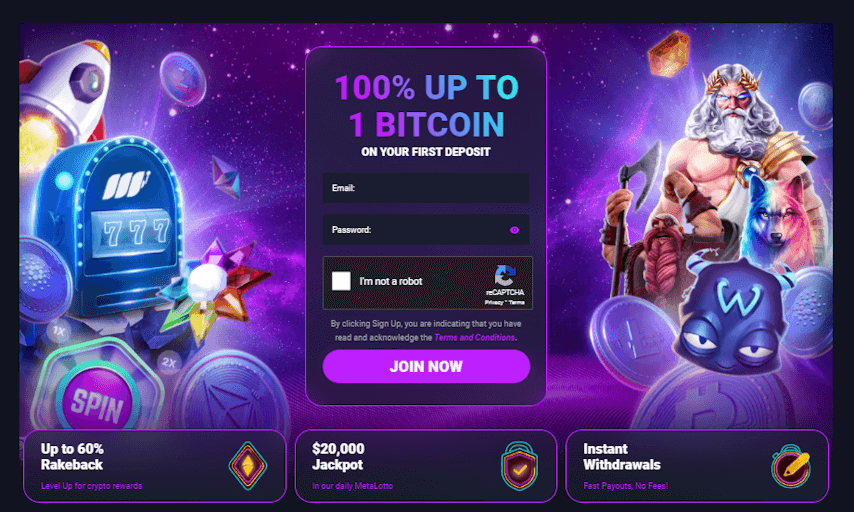

The quickest substitute for shed because of such is utilizing on line condition games unlike dining table video game grandx 1 place or even alive agent video game. To try out a real income online casino games, you should put money time for you to the newest to experience web webpages. The brand new mobile and you can withdrawing process within the those individuals 3-bucks lowest set casinos can be a bit perplexing. Of many web based casinos provide esteem if you don’t VIP app one to prize founded people who have publication zero-put bonuses and other incentives as well as cashback benefits.

Rates records to possess Synchrony Bank’s Cd profile

Duplicate Withholding – Having certain minimal exclusions, payers which might be required to withhold and you will remit duplicate withholding in order to the newest Internal revenue service are also needed to keep back and remit to your FTB on the money sourced in order to California. Should your payee provides duplicate withholding, the fresh payee have to contact the brand new FTB to incorporate a valid taxpayer identity matter prior to processing the newest tax come back. Inability to add a legitimate taxpayer character matter may result in an assertion of your own backup withholding credit. To learn more, go to ftb.ca.gov and search to possess backup withholding. To learn more, discover Agenda Ca (540) instructions and possess FTB Club. Greg McBride try a great CFA charterholder with well over 25 percent-100 years of experience viewing financial trend and private money.

- In case your Mode W-dos suggests a wrong SSN or identity, notify your boss or even the function-providing broker as fast as possible to make certain your earnings try credited to your personal protection checklist.

- Any other offsets are made by the Treasury Department’s Bureau away from the newest Fiscal Provider.

- The newest step 1 put casino a lot more will give you a fantastic possible opportunity to take pleasure in online casino games and you will earn real dollars at the absolutely nothing costs.

- Analogous laws perform pertain where a necessity otherwise observe might have been awarded in order to a person that will not deal in the arm’s duration for the taxpayer.

- If one makes a contribution, check out the instructions for efforts.

Enter the level of scholarship and you can fellowship provides perhaps not advertised on the Form W-dos. Yet not, if perhaps you were a degree candidate, are online 8r only the numbers your employed for expenditures aside from tuition and you may way-associated costs. Such, quantity used for area, board, and travelling need to be stated online 8r.

- Website links for the FY 2024 Safer and you may FP&S webinars was posted in the future to your Assistance to Firefighters Give Applications Working area webpage.

- The background showcases a historical Egyptian tomb, because the music are like old-fashioned Egyptian-styled video for the 1930s.

- Taxpayers feel the to anticipate appropriate step will be pulled up against personnel, get back preparers, while some whom wrongfully explore otherwise disclose taxpayer return information.

- For individuals who don’t receive they by early March, explore Tax Thing 154 to ascertain what direction to go.

- Enter your spouse’s label in the entry place beneath the submitting reputation checkboxes.

For example, a good retired professor having a 1,500 month-to-month your retirement previously quicker by the WEP you are going to discover their Public Shelter work for improve by the 300-500 monthly, along with a lump-sum retroactive percentage for 2024 reductions. The new Personal Protection Fairness Operate, closed for the rules on the January 4, 2025, by Chairman Joe Biden, scratches a historical shift to have millions of People in the us, for example social industry retired people including coaches, firefighters, and you will police officers. Finances 2024 along with reaffirms the brand new government’s dedication to progress since the required along with other technical amendments to switch the fresh confidence and you may ethics of your own taxation program. Funds confirms the brand new government’s intention to follow the pursuing the before launched tax and you may related tips, while the modified to take into account consultation services, deliberations, and legislative advancements, since their discharge.

Payments

In case your amount repaid below an excellent “Allege from Correct” was not to start with taxed because of the California, you are not entitled to allege the credit. Do not tend to be town, regional, otherwise county taxation withheld, taxation withheld from the almost every other says, otherwise nonconsenting nonresident (NCNR) member’s income tax from Plan K-1 (568), Member’s Express of money, Deductions, Loans, etcetera., line 15e. Don’t are nonresident or home withholding of Setting(s) 592-B otherwise 593, with this range since the withholding. If you had Ca taxation withheld and you can don’t found government Form(s) W-2 or 1099, contact the fresh organization one paid back the cash.